|

|

The Assault On The Middle Class |

|||||||||||

|

A Look At The Current Economic Collapse |

|||||||||||

|

The Current Depression Was

Carefully Engineered Let me start this piece out by stating that the current economic depression that we are currently in was meticulously orchestrated and skillfully engineered. If you haven't come to this conclusion on your own yet, perhaps you are not paying close enough attention to the cold hard facts that have come forth from this economic nightmare. The proof is in how the Fed handled, or mishandled, the matter. The notion that our best and brightest economic minds did not see this coming is pure bullshit. The fact that no one has been indicted or jailed for allowing this is disturbing on every level. Plenty of folks are pointing the accusing finger at unscrupulous Wall Street practices, and rightfully so. Wall Street and its soulless parasitic minions of greed are a huge part of the collapse. The truth is, this meltdown was a mammoth raging tsunami nearly a mile high that couldn't be missed. This in itself is a telling indicator that the fix was in. There were so many destructive mechanisms in place, that it is impossible for the financial brain trust of Wall Street and the Federal Reserve to deny foreknowledge of this catastrophe, suggesting that those on the inside were well aware of the danger that was lurking. Many causes for the economic collapse have been suggested, but the U.S. Senate issued Levin–Coburn Report found that the crisis was not a natural disaster. This was a contrivance of man that was no accident. Like an arsonist madly dousing our economic system with gas, the risky, destructive financial time bombs were purposefully laid with full knowledge of the inferno to come. A teetering mountainous landslide of U.S. debt, kicked loose by a sub-prime mortgage disaster and a bursting housing bubble, a liquidity shortfall within the banking system, improper predatory lending practices, and a thermonuclear derivatives time-bomb of mass destruction... to name but a few of the numerous triggers... all should have been apparent and raising red flags with regulators and anyone with half a brain to spot the danger. The list of risky programs and questionable activity is quite lengthy and too hard to deny or escape for those involved, along with the institutions charged with overseeing the nation's financial well being. So how did our best and brightest allow this to happen? It took time, so the architects of this collapse are many... Warren Greenspan, Paul Volcker, Robert Rubin, Larry Summers, Hank Paulson, Jon Corizine, and Tim Geithner, to name a shortlist of those who should have known better. Are they all incompetent morons, or were they willing facilitators in the greatest economic destruction in world history?

Where was the SEC in all of this? Were they just that stupid, or

perhaps, did we have collusion from within? The warning signs were telltale and

glaringly obvious, yet no one could see fit to blow out the match that touched

off the incendiary that burned another Rome to the ground.

Highly risky financial offerings from the large banks and private lending

institutions were certainly major contributors, but many undisclosed conflicts of

interest and ethics were also involved in blatant overtures of greed. Through it all, government

regulators, such as the SEC, failed to do their job by stepping in. No

agency raised

the red flag on our financial institutions or that of Wall Street, causing many to

allege collusion within the regulatory apparatus.

Before we get too far into this, it needs to be noted that the Clinton administration's repeal of

the 1933 Glass–Steagall Act was a major contributing factor which removed the

wall that used to exist between deposit banks and Wall Street investment firms.

The Glass-Steagall Act was put in place as part of Roosevelt's

New Deal, to prevent the environment of greed and corruption that devoured over

5,000 banks and led to the first Wall Street crash of 1929. The perpetrators

behind the repeal of this safeguard knew full well what they were doing. They

willfully removed a prominent cornerstone of protection, for their own profit,

but also with a greater evil at hand.

From that point it was Katie bar the door. Had that act been left in place, it

is safe to say that much of the financial crimes perpetrated against the system

would not have been allowed. The Clinton administration is as culpable as the

Bush administration in the engineering of this latest economic depression. Both

must share the blame.

Just look at the lecherous looks of glee and giddiness present on the

faces of the soulless parasites in the picture above. They knew full well what

they were doing. While the Clinton administration was responsible for re-opening

the door for the return of Wall Street corruption, the Bush administration

was guilty of allowing the fraudulent exploitation of the system and its ensuing destruction.

Perhaps the worst of the major nuclear financial bombs concocted

has been, for all

intents and purposes, a pure gambling scheme among the financial institutions, a

betting practice known as derivatives. You may have heard about this

scheme by now, but few understand the scam. Indeed, it is quite involved and

complex for the average person, but that's what made it so deadly. Outside of

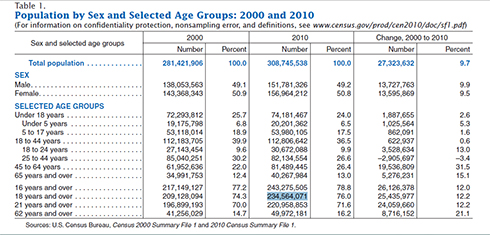

the unscrupulous players in this deadly game, few knew of the dangers that existed. Again, derivatives are nothing more than financial gambling. It is an un-regulated scam that totals roughly $1.2 quadrillion dollars! Not trillion folks... a QUADRILLION, as in one thousand times one trillion. Try to wrap your head around a quadrillion dollars. Seriously. Stop for a moment and think about a number that outrageously large. The whole derivatives scheme is nothing more than one big casino crapshoot. A potentially devastating nuclear WMD, without a doubt, and that is not overstating the analogy. The point here is that there have undeniably been blatantly reckless games of financial "chicken" being played out among our monetary institutions. The ultra-wealthy elite that perpetrated these destructive schemes knew better, yet they continued on with greed as their sole guide. What's worse is, our regulatory agencies, such as the SEC, clearly should have known better, but instead they turned a blind-eye to it all. Now, without going on any further on the cause of this economic nightmare, suffice to say, there are numerous bright financial minds out there, people educated with finance majors working within our government regulatory agencies that should have seen this economic tsunami coming. To say that absolutely no one saw this looming on the horizon is quite questionable, but if true, it's a chilling revelation that doesn't offer much confidence that we have the best and brightest watching over our financial institutions. To the contrary, some observers have insinuated the uncomfortable notion that this economic holocaust was manufactured. I know, That's a bold notion to entertain, but there are many indicators to warrant this suspicion, as well as the aforementioned ignorance by our government regulatory agencies that all looked the other way. Why would anyone do such a thing on purpose? Greed, money and power obviously come to mind, but the number one goal that will shock many was to break this country in order to establish the Rothschild-Rockefeller plan for a new world order. This plan would grant world domination to the super-rich. Don't laugh too loud, because this plan has been in the works for many years, with backing from the Bilderberg Group, the Trilateral Commission, and the Council on Foreign Relations (CFR). Many politicians the world over are in on the scheme, including Henry Kissinger, Zbigniew Brzezinski, Bill Clinton, George HW Bush, Gordon Brown, David Cameron, and a host of others. It is a well organized cartel of trillionaire banksters, with a cabal of political leadership. Make no mistake about it. All the signs are there to prove that this economic collapse was no accident, as the U.S. Senate issued Levin–Coburn Report found. This plan has been underway for many years, under Reagan, Bush I, Clinton and Bush II. The real death blow came after 9/11, another event that was engineered to push us into this new world order. The aftermath of that event, plus the groundwork laid under the administration of Bush II, had much to do with driving the final nails into the coffin of the United States republic. When viewed in this light, much of the unfathomable becomes quite clear. The 2008 collapse wouldn't be the first mishandled disaster to come from the infamous Bush-Cheney regime. Not only can that integrity challenged administration claim the worst domestic attack ever on United States soil with 9/11, they are also on the hook for a wretchedly piss-poor response to the Katrina gulf coast disaster, in addition to a still unresolved anthrax attack which pressured lawmakers into compromising our Constitutional rights with the infamous Patriot Act, topped off with ownership of the worst economic collapse that the world has ever known. That's quite a resume. A strong argument can be made that despite all of the new "safeguard" institutions such as Homeland Security and TSA, along with the ensuing controversial security legislation (Patriot Act, Military Commissions Act, Homegrown Terrorism Act), the Bush administration actually weakened our country, rather than strengthen it. Again, all of this was by design. The last act to damage our country (and the world) is the increasingly dire economic collapse of our financial system, the proverbial straw to break the camel's back. Many would say this is preposterous, but all they have to do is look, for they would be remiss to make a denial without first doing their homework. All the evidence is there, if you just look. It's the Hegelian Principle at work, create the problem, elicit a reaction, then propose a solution that would never be considered under normal circumstances. The solution to the problems we're facing now will be the new world order, because that is their overall goal for control and world domination. Others will contend that it just can't be true because it's not on the TV news; a naive assumption if ever there was one. Sadly enough, our overly revered media is controlled and has been complicit through it all. Money can have quit an affect on morality. But let's get back to the second engineered economic collapse of our country, the third attack by the wealthy on the United States for the purpose of fascism. So after this financial time-bomb exploded in 2008, what did the Bush administration do? They immediately bailed out the ultra-wealthy perpetrators to the tune of $700-plus billion dollars. In essence, they rewarded the crooks that caused the collapse with hundreds of billions more, icing on their cake of criminal collusion and malfeasance. This in effect exacerbated the crisis even more. It was throwing more gas on the arson fire. At the same time they placated the poor and middle class with diminutive offerings of $300 to $1,200 in IRS stimulus checks, an insult compared to the hundreds of billions of dollars in Federal Reserve notes that they lavished Wall Street with. Strangely enough, those that were the richest and had the most were given the most. The indisputable insult to injury is that Goldman-Sachs was showered with billions of dollars, and then reported huge profits as a result. Not only was this an insult because they were in on the entire scheme, but they also then turned around and handed out $14-billion in bonuses to their chief executives! These people have no moral integrity, nor have they any shame. (See Max Keiser: Report 1 | Report 2 ) Where was the payout to the American people from these corporations after taking bail-out money? If we get money from a bank, we are required to pay that money back, with a sizable interest. So where is the extra profit to Americans? Oh that's right, the Fed is not owned by us. It's a private cartel of ultra-wealthy bankers. So how is it that we often get stuck for many of these bills? Shouldn't these belong solely to the bankers running the Fed? The Bush bail-outs totaled 1.8-trillion after billions paid out to AIG, JP Morgan-Chase, Fannie Mae and Freddie Mac, plus the GM bail-out, to name but a few. Then came Obama with his false promise of "hope and change." Instead of change, he furthered the Bush policies, plus added to the bail-out of the ultra-rich by handing out another $800-billion-plus to the immensely wealthy institutions that were part of the attack on our economy. (And coincidentally enough, Goldman Sachs was a major campaign contributor to Obama.) So this was the official government response to stimulate our economy... give those that have the least and need the most the smallest amount, but for those that already have the most, they get the most of all, to the tune of trillions of dollars. Think about the rationale in that thinking for just a moment. Wouldn't those that have the least spend more to get what they don't have? Those that have the most certainly need less, so they can thus sit on their money, with no real immediate jumpstart of the retail economy. So what kind of economic stimulus does that provide? So, let's start doing some math now. If we just add the initial $700-billion from Bush, plus the $800-billion from Obama, you have roughly $1.5-trillion doled out by the Fed in bail-outs to the rich. If you want to add in all of the Bush bail-outs in conjunction with Obama's, you get a figure much closer to $3-trillion (2.8). Not to overstate the obvious, but that's an awful lot of money to bail out those who either dug their own grave, willfully, or else exacerbated the collapse, yet are still far better off than the rest of us. Now, here comes the real kick in the groin folks. The first ever audit of the Federal Reserve has recently revealed that the Fed instead secretly gave out $16-trillion dollars in bail-outs. Let me say that again... $16-TRILLION dollars! This was reported by Senator Bernie Sanders and a few other web outlets, but it seems to have conveniently slipped by our mainstream corporate news media. And not only did we reward the ultra-wealthy and fortune 500 companies, we also paid out to foreign entities as well! Yes sir, screw the American people, but let's help out the foreign banks instead. The truth is, we bailed out other countries as nothing more than pure bribery to keep them on board and backing the dollar of the fraudulent Federal Reserve system. If they leave the dollar, the Federal Reserve loses its control. It's as simple as that. Maybe this is the reason why our corporate controlled media decided to conveniently avoid revealing a $16-trillion bail-out, because U.S. taxpayers would literally rise up in an uproar over money they would more than likely be on the hook for, in some way, shape or form. And some analysts suspect the payments were closer to $28-trillion! At any rate, this was the official government response from lil' Timmy Geithner and the crooks at the Federal Reserve, which, again, is a private banking cartel and is not a federal institution. This one-sided stimulus plan is what those greedy soul-sucking parasites at the Fed thought would stimulate our economy, insulating the ultra-wealthy with vastly more obscene wealth. What a concept. Now, let's take perhaps a more practical approach. Let's take that egregious outlay of unfathomable wealth, $16-trillion dollars, and instead give that to every single American that is age 18 or older, rich and poor. According to the U.S. Census table below, you will see highlighted in blue that this figure is 234,564,071 people.

Get your calculator out and divide $16-trillion by the persons 18+ figure. You should get $68,212 dollars for each of these legal adults. That's a nice stimulus check for working Americans. If you omit the richest, who don't need the money anyway, and you divide that money amongst adults with meager incomes, we could have all received checks of $70,000 to $100,000 plus, per person. Talk about a real economic stimulus! Putting this money in the hands of "we the people" would clearly have provided more stimulation of our economy than giving it to rich corporations and banks that refuse to lend it out. Somehow our brightest minds at the Fed apparently missed this win-win scenario. Or did they? Perhaps the bailouts are insulation for the rich, to weather a perfect economic storm that is still brewing. The purpose, save the rich, but damn the poor and middle class. So think about this for one minute. Wouldn't giving $100-thousand dollars, or even $68-thousand dollars to U.S. citizens have far more of an impact on our economy than giving billions to rich companies that don't need it? Banks were given that money for lending, but instead most of them chose to sit on it, to line their coffers in case of more economic hardship. Rather than lending it out, as they were allegedly supposed to do, some chose to buy up other failing corporations and banks, making themselves wealthier at taxpayer expense. If you and I were given $68-thousand, or $100-thousand dollars, we would no doubt spend it, paying off credit cards, paying outstanding utility bills, paying off loans and home mortgages, or buying a new car, appliances, furniture, and things that we need. The important point to note is that most of us would not just sit on it, as the banks did. This would have been a far better recourse to stimulate the economy. Giving $16-trillion dollars to the American people would have indisputably stimulated retail, which in turn would have jump started manufacturing and industry, all of which would have translated to more jobs and decreased unemployment significantly in this county. In the end, all of the money would have eventually found its way to the banks that it was given to in the first place. Isn't this essentially provoking the capitalist system that fuels the economic engine that runs our country? So why then did we bypass three vital components of our oft heralded economic system?

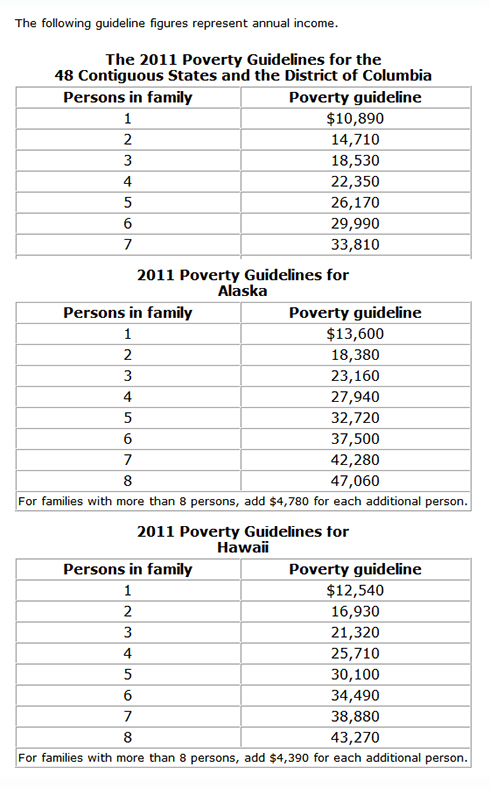

We also missed out on stimulating jobs and the employment crisis. And we would have staved off the mortgage crisis! Our best and brightest economic minds couldn't have figured this out? Seriously? Why, oh why did we just hand out the money straight to the banks and the Wall Street villains that perpetrated the fraud and collapsed our system in the first place? Does that really make any sense to you? Let me make one thing very clear, this author is not the world's brightest economist. Far from it. So how is it that a simple solution such as that proposed here was missed by the best and brightest minds within the Federal Reserve? How is it that our top officials naively thought that this plan from Hank Paulson, Ben Bernanke, and Tim Geithner was best for America? This author's take is that this was all done with calculated purpose, with devastating effects and consequences in mind for the poor and middle class. Let's examine the rationale for why this was more than likely done the way it was. If the richest corporations and banks get the bailout money, they are insulated from any adverse economic shortcomings during this crisis. They are in effect made much stronger, with the resources to now gobble up struggling and failing entities, much the same as happened during the first great depression. The mega-wealthy become much more powerful as a direct result. There are other advantages for bailing out these "too big to fail" institutions, rather than the American people. By impoverishing the middle class, you in effect create a very large and desperate labor pool that no longer has any leverage over wages and working conditions. What you get is an enormous sea of people desperate for any job that will keep them working in order to feed their families. Companies no longer need to promise benefits, or even a minimum wage, because when the economy gets so bad, people will be forced to capitulate and work for whatever they can get. Advantage to the corporations and the rich. So bailing out the corporations puts them in a position to be stronger regarding market strength and industrial growth, with clear advantages over labor. Ignoring the people during the bailouts puts us in a weaker position to negotiate working conditions and wages. A fascist system of complete control that favors the corporate state rather than labor. As the economy struggles, here are some figures that do not pertain to those rich enough to enjoy the spoils of life, but say everything about the dire emergency that threatens the lower and middle classes. Over 46-million Americans are impoverished, with most of them being on food stamps. That is a staggering figure because the qualification for food stamps is considerably under the poverty line. A very sad statistic is that 40 percent of these food stamp recipients have a job, a very poor paying employment that does not allow them to exist with a good quality of life. Undeniably the worst statistic of all is that 75 percent of those receiving food stamps are families with children, and one-third of recipients are elderly adults, or people with disabilities. The number of Americans on food stamps is fast approaching 50-million. That is 1/7th of the population, or 46-million people from arguably the richest nation on earth. As we quickly approach 50-million food stamp users, that number quickly jumps to 1/6th of Americans living far under the poverty line. Understand that you have to be far under the poverty line to qualify for food stamps. Just being impoverished does not entitle you to food stamps. A single person has to make under $677 per month in order to get food stamps. That is far below the poverty line for a single person. (see table below) So even though a person might meet the poverty level, they have to be far under that, by $2,766 dollars a year. Even though the poverty level for one person is $10,890 per year, they only qualify for food stamps if they are making $8,112. If you're not getting the point here folks, the gist of this simple analysis is this... those 46-50-million people that are on food stamps are considerably under the poverty line. Before the economic depression began there were 26-million Americans on food stamps. That number has nearly doubled since 2008, an increase of 20-million people. We now have in excess of $46-million on the program, according to spring 2011 figures. That number is most certainly higher by now as we rapidly approach 20 percent of the populace using food stamps. That's an unbelievable number for arguably the richest country in the world. What's worse is that the government estimates that 23 million more are eligible for food stamps, but don’t apply for them for reasons of pride and personal embarrassment, all initiated from right-wing fomented guilt. A fact that many people don't know about is that the JP Morgan companies make money off of food stamps. So not only are the ultra-rich fat-cats willfully sponging off the system through corporate welfare to bail them out, but they are also making huge money off of the starving poor. What a racket. For anyone thinking that those accepting food stamps are themselves sponging off the system, you should know that the Average Monthly Food Stamp Benefits per person was a mere $133.79 in 2010 (Kaiser Family Foundation website – State Health Facts). That’s roughly $1,605 per year. The average for a household is a paltry $284 a month. So let's do some more math. If you multiply $1,065 times 46-million people you get approximately $49-billion per year, on the average. The official figure for 2010 was $68-billion. Compare that figure with the hundreds of billions in unpaid taxes from our richest corporations and mega-wealthy millionaires and billionaires, each and every year, and you get a clearer idea of the real freeloaders in this country. So who is sucking the most out of the system? Clearly it is those who have the most, the ultra-rich fat cats, yet that's not what the far-right pundits will pontificate about. All they can scream about is how much the poor take from the system. This has got to be one of the greatest lies ever told. The rich are the ones bleeding our society dry. The poor are merely an aftereffect of their avarice. The most disparaging number is when you compare this yearly food stamp figure to the $16-TRILLION that was secretly and illegally handed out by the Fed to the rich bankers and corporate elite who caused our economic collapse.

Poverty has been growing in America, more so since

the economic collapse of 2008 which began under Bush II and has now continued

under Obama. Over 46 million Americans live in poverty, the highest figure

ever in 52 years, since poverty figures have been kept. A look at the statistics

is all one needs to paint a grim picture.

As with all manipulated government figures, poverty is defined by family size and income. The federal government considers a family of four with a yearly income of less than $22,314 to be poor. So what about families of three? Is $22k really a livable income? Add these families to the equation and the poverty level in the U.S. rises dramatically higher. By "government standards," we are easily at 1 in 7 Americans in poverty, and fast approaching 1 in 6. That is a glaring figure for a country that claims itself to be the richest nation on earth. To add insult to injury, quite literally, there are now 50 million Americans who do not have medical insurance. This figure can only exacerbate the number in poverty as these people become sick and thus bankrupt themselves with exorbitant medical bills. It can be argued that the ultra wealthy have helped to perpetuate the sustainability and growth of this poverty cycle through the healthcare issue. It was the richest Americans who lobbied to keep the healthcare debate from a successful resolution, unless they were rewarded with round two of the Bush tax cuts. Once Congress acquiesced to that pressure, the richest did not hold up their end of the deal, instead turning on the poor, as well as 9/11 first responders, who were also tied to the political blackmail over a continuance of the Bush tax cuts. The U.S. might have a good deal of wealth, but it is sadly enough concentrated in the hands of 1% of the population. The number is even smaller if you look at billionaires alone. With 410 billionaires in the U.S., that is 1 in 751-thousand Americans. Clearly, the greatest mass of money sits in the hands of a select few.

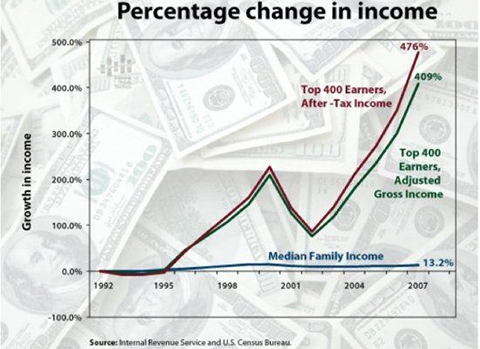

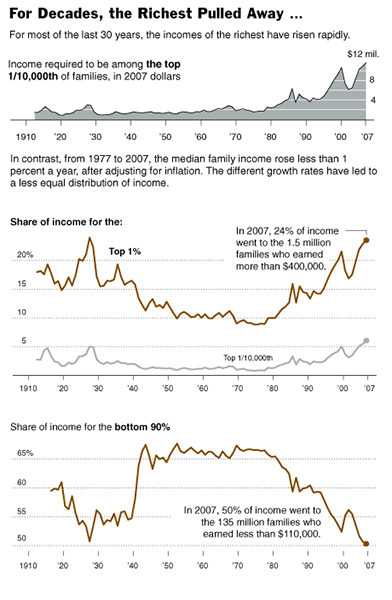

The poor in this country are not responsible for our current economic disparity. They did not choose to be poor. They are but a by-product of a very poor unchecked system of bad capitalism. The amount of corporate welfare and tax dodging by our billionaires and multi-millionaires far eclipses that of any lower class welfare fraud. That is an indisputable fact. We have billionaires and multi-millionaires who pay zero in taxes, all the while the poor and middle class are jailed for the same offense. The August 2008 GAO report from the General Accounting Office points out that two-thirds of U.S. corporations also pay zero in taxes, as do 68% of their foreign corporate counterparts. If you go back to 2005 you can follow the trend. According to CBS News, "More than 38,000 foreign corporations had no tax liability in 2005 and 1.2 million U.S. companies paid no income tax, the GAO said. Combined, the companies had $2.5 trillion in sales. About 25 percent of the U.S. corporations not paying corporate taxes were considered large corporations, meaning they had at least $250 million in assets or $50 million in receipts." Folks, this is essentially treason, for it deprives our country of trillions in unpaid taxes. At the very least it is outright criminal theft for which middle and lower income citizens are imprisoned for far less amounts that are infinitesimally diminutive by comparison. In the end, it is the middle and lower class that is forced to pay for that which the rich refuses to. That must be what they mean when they say that "wealth has privileges." So again, no matter what the misinformed say, or the disinformation pundits try to tell you, corporate welfare and tax fraud by the mega-wealthy far outweighs any free-ride that is falsely attributed to the lower or middle class. It's not even close folks. And don't say the ultra-rich provide jobs and keep this country running. These are corporations that take their companies offshore, along with their jobs, all the while they exploit our economy, damage our highway infrastructure with their large semi-trucks, and pollute our environment, at taxpayer expense. They are making the profits while leaving the bills to you and your children. During the Great Depression, unemployment stood at roughly 25 percent, with one in four Americans out of work. Despite the well managed unemployment statistics today, many allege that number is already near 20 percent, because the government is not counting those who have exhausted their benefits and have been kicked off the unemployment rolls. Ah, the beauty of massaging numbers. With the economic crisis strangling our middle and lower class, all Congress can talk about is where to make cuts. Despite all of the evidence that the rich are doing quite well through this depression, someone is coercing our Congress to consider cuts that affect those hurting the most. Much talk has been spent regarding cutting holy-grail expenses such as Social Security, Medicare, and food stamps. Given the statistics already pointed out, this is tantamount to criminal behavior. With all of the above facts about wealth in mind, it is unconscionable that anyone could consider cutting necessary social programs, rather than increasing taxes on the 1% who have increased their wealth since the Bush tax cuts. The top 400 richest in the U.S. are all billionaires. This lofty subset of the wealthy has seen their wealth doubled under the Bush tax cuts, and continues to grow during this depression. To have their wealth grow in a depression proves that the game is rigged against us, and clearly in their favor. They profit as we suffer. Let's look now at one of the major government causes for our economic crisis, military spending. If you take into account the perversely obscene US Military Spending vs the World, with its 2011 Pentagon Budget of $530.8B, you will hopefully understand why it is inhuman and immoral to consider going after the middle and lower class. Our military outspends all other countries combined, by a vast amount. That's a fact. Take every other country in the world and lump their military budgets together as one, and they still pale in comparison to U.S. military spending. Outspending our closest adversaries easily by a 5 to 1 margin is undeniably immoral, unless of course you're working for a totalitarian police state and world domination. For anyone to think that the way out of this mess is to make the lower and middle class suffer more is ludicrous and borders on psychopathic behavior. To this day, a model has now been constructed that enables the richest to become richer, while the middle class and poor become poorer. Those that are the wealthiest have suffered the least under this current economic depression, while the poorest have lost the most. As a result, the gap between the rich and the poor has become much larger. A year before the economic meltdown, the richest 1% controlled 34% of the nation's wealth. That figure in 2011 is fast approaching 40%. The total wealth of 63 percent of all Americans has declined in this period. These are alarming, staggering figures. The average American reportedly make a mere $38 thousand per year. This figure is quite disingenuous because it would clearly be a much lower figure if you took the millionaires out of the equation, along with the 410 billionaires. The true disparity in wealth is very much hidden, for obvious reasons. It would be tough to herald our brand of capitalism as the better system if people understood the huge divide that exists between the rich and poor.

U.S. Census Report: 1 in 6 Americans Are Poor, One in Five Children Live in Poverty Meanwhile the U.S. National debt sits at roughly $15-trillion. As a reminder... this is one trillion less than the secret payout of $16-trillion by the Federal Reserve to the richest of the corporations, banks, and Wall Street institutions. It needs to be noted that from the time of George Washington up to Ronald Reagan the U.S. government accrued about one trillion dollars of debt, yet we are currently tacking on over 1.28-trillion just this year alone. Here are some startling numbers for Americans to chew on: In a recent newspaper article, "The fast track to inequality", reporter Bob Herbert of the St. Louis Post Dispatch observes that the top CEOs in America all saw their incomes increase 5 times during just the last year of the Bush administration. Fives times in one year! What American worker ever gets more than one raise in a year? FIVE raises for corporate CEOs in the last year of the Bush administration. This is absolutely unconscionable. Talk about outrageous avarice, audacity and just plain blind hubris... five raises in one year! The Bush tax cuts have been a huge detriment to the economy. Clinton taxed the wealthy at 36 to 39 percent, far lower than 1960's levels, yet it gave the U.S. a projected surplus for the first time in decades. The Bush tax cuts cost the country $1.8 trillion, according to the Tax Policy Center. Since 2008, the total cost of the cuts has grown to $2.3 trillion through 2010. Total income was nearly $3 trillion less ($2.74) during the years of Bush.

Adding insult to injury , those making $200,000 or more and paying NO federal income taxes was through thee roof in the second term of Bush. Ten years before, the number of those skipping taxes was less than 1,500. In 2000 the number was 2,300, however the number skyrocketed to 11,000 rich freeloaders in 2007 and then DOUBLED to 22,000 tax free cheats in 2008. One of the wealthiest men in America, Warren Buffet, pays a total tax rate (federal, state & local) of 0.2% of his income and investment gains. By comparison, the average American who earns a paltry minimum wage has to pay a tax rate of 22% of their wages. This figure is 100 times the tax rate of Buffet and the excessively wealthy. For all the lying that the conservatives do about welfare fraud by the poor, whatever the true number is, it is infinitesimally diminutive compared to the outrageous trillions that the rich steal from our capitalist system. Hands down. There is no close comparison. The disparity between the figures is staggering, with the ultra-rich reaping the greatest fraud of all. There is no contesting this fact. Anyone that tries to do so is ignorant and has not done their homework, or they are bald-faced liars. Summary In light of all of these disproportionate figures and the growing wealth inequality that appears to be built into our system of capitalism, it is no wonder that many feel this economic collapse has been engineered to bring the middle class to its knees, to grovel at the feet of the wealthiest for slave wages, with little or no benefits. The Federal Reserve and our government economists know these figures regarding the poor all too well, yet they chose to help those who have the most, who have the best chance to survive, versus the average American. This excuse about "too big to fail" is absolute bullshit when applied to mega-wealthy fortune 500 companies. Far be it for them to see a little profit loss, as opposed to Americans who are losing it all. Excuse me, but "too big to fail" is 308-million people who comprise the better part of our system of capitalism. Bailing these people out would have in effect eventually bailed out the big corporations, because the flow of goods and services would continue. Again, knowing all of this, our best and brightest economic financial minds decided to turn their back on these people, skipping the middle man and jumping right to the end of the line. So much for their faith in our system of capitalism. They chose an unreasonable solution to healing the ills of a nation. Instead they deferred to helping the richest, rather than the poorest or those struggling the most. How anyone can claim that our best and brightest economic minds at the Fed did not see this economic disaster coming, either questions the intelligence of those asking the question, or those running the Fed. If the Federal Reserve truly cared about salvaging our country, they would have identified the real problem and bailed out the people instead. The people are the true backbone of our economic engine. Companies can have all the goods and services they want, but if the people can't afford them, what good does it do for the corporations? If our government was truly representative of the people, it would have addressed their needs and saved their jobs, their homes, and their well being. The most obvious solutions that would show a logical attempt to dig the U.S. of of its massive hole would be to:

In light of the economic disparity coming forth since the 2008 economic collapse, coupled with the fact that the Federal Reserve has insulated the wealthiest from harm, it could be said that our brightest economic minds do know what they are doing, and it is not in the best interest of the middle or lower class. The evidence is clearly in who the Fed has bailed out. It is also in the fact that the top 500 corporations have increased their holdings since the 2008 crash, by 60 percent! This gross aberration of our economy is coupled with the undeniable fact that the wealthiest are getting richer, during one of the worst depressions ever known to man. Once again, the secret payout of $16-trillion dollars is the smoking gun here. When you realize that each U.S. citizen 18 years or older could have been given $68,000, but the Fed chose instead to reward the wealthiest, you start to get the idea that this economic nightmare is nothing but sweet dreams for the ultra-rich who concocted this disaster, for their benefit and the death of the middle class. Going a sep further, if you exclude giving bailout money to the rich, and instead gave it to Americans 18+ that make under $200,000, each of these deserving needy people would receive a check in excess of $100,000. Once again, this would have been a far better way to stimulate the economy. Those less off would have paid overdue mortgages, stopping the housing crisis. These people would have made much needed purchases, thus stimulating retail sales, which in turn would have stimulated factory production, all of which would have made its way to the banks. The cycle of capitalism would have been invigorated and renewed. This is a no-brain win-win for everyone involved. It would have been a boon to the country, but for some reason our best and brightest minds at the Federal Reserve sought to bypass the inner workings of our oft heralded capitalistic system, instead choosing to cut out everyone in between and give the money directly to banks and wealthy corporate 500 companies. All these institutions did was buy up less solvent companies and financial institutions, making themselves much stronger for mere pennies on the dollar. Those familiar with history may remember that this is the exact same scam that the wealthy pulled on America during the first engineered great depression. This is the second time our highly vaunted system of capitalism has collapsed in less that 80 years! And lest anyone forget the fascist coup by the wealthy on FDR in 1933. The rich are treasonous, morally deficient, soulless, greedy parasites who have indeed reserved for themselves a special spot in hell. Make no mistake about it, when weighing the figures and data above, all signs point to the obvious... the Federal Reserve and the ultra-rich engineered and orchestrated this latest economic collapse to benefit themselves and to crush the middle class. In light of their short sided remedial course of action, it is hard to figure otherwise. Needless to say, in this environment of greed and financial corruption, Robin Hood would certainly have his work cut out for him. A fascist state is upon us folks. We must end the Federal Reserve system and the rule of the rich oligarchs now, before they put an end to us.

May God help us all.

Fact: When The Rich Get Richer, The Rest

of Us Get Poorer

Predatory Capitalism: How The Poor

Get Poorer See also:

Reference: Who Rules America: Wealth,

Income, and Power

Tour of the

US Income Distribution: "The L-Curve"

Who are the

Architects of Economic Collapse? Hunger in America About Poverty (US Census Bureau) U.S. snapshot in food stamps Truer U.S. unemployment rate hits

recent high of 17.5% U.S. Census 2010: Income

Statistics U.S. Census 2010: Income

Inequality U.S. Census 2010: Income, Poverty

and Health Insurance in the U.S.: 2009 IRS Tax Statistics Fiscal Facts: Summary of Latest

Federal Individual Income Tax Data So How Did the Bush Tax Cuts Work

Out for the Economy?

US

Census Bureau Poverty

2011 HHS

Poverty Guidelines

2011

Federal Poverty Guidelines

Counting Down To A Global Meltdown

Economic Black Hole: 20 Reasons Why The U.S. Economy

Is Dying And Is Simply Not Going To Recover

GAO Report Finds That 2/3rds of Corporations Pay

No Taxes

Return to

NewsFocus.org |

|||||||||||